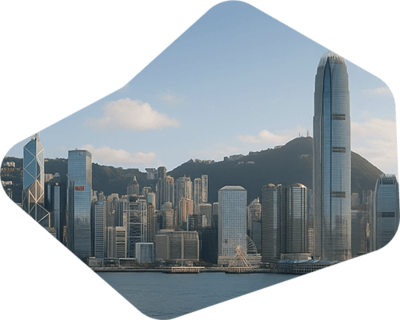

Zetland Hong Kong

INTRODUCTION

Hong Kong is the core of of Zetland's operations and our main business location. From our centrally located office, we coordinate services across the globe, leveraging Hong Kong's robust legal system, efficient regulatory landscape, and global connectivity.

With decades of experience serving both corporate and private clients. Zetland Hong Kong is the operational hub for our network of offices and fiduciary experts. Our Hong Kong office delivers our signature level of personal service and professional integrity to clients ranging from entrepreneurs and families to multinationals and institutional investors.

As a leading international financial centre, Hong Kong provides a highly favourable tax environment with one of the lowest corporate tax rates in the world and no capital gains tax, dividend tax, or value added tax. The tax system is territorial—only income derived from or arising in Hong Kong is taxable—offering clarity and simplicity for global investors. Businesses benefit from transparent tax rules, streamlined filing procedures, and various incentives for SMEs and international entities. These attributes, combined with Hong Kong's free flow of capital and legal certainty, make it an ideal jurisdiction for company formation, investment vehicles, and wealth preservation.

Address

5/F Chung Nam Building, 1 Lockhart Road, Wan Chai, Hong Kong

Hong Kong Services

Zetland Fiduciary Group provides a full suite of corporate, fiduciary, and advisory services from our Hong Kong office. Our experienced multilingual staff are able to offer our services to our clients, either directly or through our network of experienced professional partners.

Company Formation and Administration

Nominee Shareholders and Nominee Directors

Bank Account Opening and Operation

Trusts Establishment and Administration

Provision of Trustee and Protector

Accounting and Tax

Formation of Private Trustee Companies

Formation, Operation and Administration of Special Purpose Vehicles and Funds

Human Resource Planning and Management

Agency Services

Offer clients a full service in the fiduciary sphere

Provision of Registered Office

Company Secretaries

Family Office

Background

After the First Opium War in 1841, Hong Kong was established as a British colony. Under the terms of the Joint Declaration in 1984 between Britain and China, Hong Kong reverted back to Chinese sovereignty on 1 July 1997. Hong Kong became a Special Administrative Region of China, a concept based on 'one country, two systems' allowing Hong Kong to retain its political, social, commercial and legal system; and manage its own economic and financial affairs.

Since the 1997 handover, Hong Kong has maintained a distinct identity under the 'one country, two systems' principle. It continues to operate as a separate legal and economic entity from mainland China, with its own judicial independence, free-market economy, and open financial system.

These features have preserved investor confidence and enabled Hong Kong to remain a leading destination for regional headquarters, offshore investment, and international commerce. Its global outlook, multilingual business culture, and world-class infrastructure reinforce its position as one of the most business-friendly jurisdictions in Asia.

Legal & Business

Hong Kong's legal system is rooted in English common law and supplemented by an expanding array of statutes enacted by the local legislature. It operates efficiently, with competent courts. Hong Kong boasts many law firms that includes international firms from the United Kingdom, Australia, Canada and the USA.

The Hong Kong government has adopted a 'Positive Non-Intervention' policy and generally makes no distinction between local and foreign companies. Since October 1983, the Hong Kong Dollar has been pegged to the US Dollar at the rate of HK$7.8 to US$1 and there are no controls over foreign exchange or the remittance of funds.

Hong Kong serves as a regional business centre in Asia with well-established commercial links with most Asian countries. Hong Kong holds a unique position with China in relation to business which has been enhanced through the Closer Economic Partnership Arrangement (CEPA), allowing Hong Kong companies tariff-free access to the Chinese market for certain goods and concessions for service companies. Since the introduction of CEPA in 2004, China and Hong Kong signed a further six agreements bringing further co-operation measures and services liberalisation which has provided a solid foundation of economic integration between Hong Kong and China.

Economy

Hong Kong has always been a major trading centre. During the post-war period, the local economy developed rapidly in the field of manufacturing, largely in textiles and consumer good products such as toys. With the rapid development of the Chinese economy in the late 1970s, manufacturing has since, increasingly moved out of Hong Kong and into China though some high value manufacturing remains.

Hong Kong's economy is heavily dependent on tourism and services; it is also popular as a regional headquarters for many multinational companies. The real estate sector thrives within the territory and increasingly overseas in countries such as China, Malaysia and Vietnam. Hong Kong has independent membership to several international bodies such as the World Trade Organisation and for most international purposes is and will continue to be treated as a separate entity from China.

Finance & Taxation

Hong Kong is a major international financial hub with a large representation of commercial banks, merchant banks, insurance companies, fund managers, venture capital companies and other financial intermediaries. The local stock market is highly liquid and is actively traded. Hong Kong is the major centre in Asia for fund management and has substantial currency, gold and securities trading activities as well as being a focus for the provision of equity and loan based capital.

While there are no restrictions on investments in any part of the economy, there is close supervision in some areas, primarily in the financial sector. Hong Kong's stock market is also one of the world's largest in terms of market capitalisation. In 2003, Hong Kong was designated by the government of the People's Republic of China as Renminbi (Chinese currency) clearing centre allowing local banks to establish Renminbi accounts.

Taxation in Hong Kong is based on a Territorial Source Principle rather than on residency, management or control. This means that Hong Kong companies will only pay tax on profits sourced in Hong Kong at the current rate of 8.25% on assessable profits up to HKD$2 Million and 16.5% on any part of assessable profits over HKD$2 Million. There are no withholding taxes on dividends or interest and no taxes on capital gains.

General

Hong Kong is an interesting and vibrant destination offering a range of upscale hotels and restaurants, as well as outstanding shopping and entertainment options. It is a convenient hub for travelling to mainland China or neighbouring countries. The climate features distinct seasons, with a hot, humid and rainy summer and cool but dry autumn and winter. The typhoon season lasts from July to September, although strong typhoons are relatively rare. The best months for visiting are between October and February, with October generally being the peak month for business travellers in the territory. Additionally, there are numerous sporting, cultural, educational and exhibition events throughout the year which attract large numbers of visitors to Hong Kong.