Author: Roger Frick

This article was contributed by ATU (Allgemeines Treuunternehmen), an independent fiduciary service provider in Vaduz, Liechtenstein.

Legal

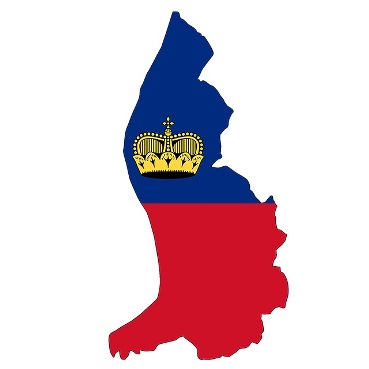

Liechtenstein is situated in between Switzerland and Austria, in the centre of the Alpine arc. With a total area of 160 square kilometres and population of 38,557, it is the fourth smallest country in Europe. Liechtenstein became 300 years old in 2019.

Its political system is very complex and is a ‘constitutional, hereditary monarchy on a democratic and parliamentary basis’. Put simply, the Principality is a semi-constitutional monarchy headed by the reigning Prince.

Liechtenstein is a civil law country. As such, case law does not play as important a role as in Anglo-Saxon jurisdictions, though it does exist. The court system is very efficient.

Liechtenstein is a blend of Austrian and Swiss law, though it retains its own specifics in regards to procedure. Furthermore, Liechtenstein is the first and only country in continental Europe to adopt the concept of trusts.

Advantages of Foundations and Trusts in Liechtenstein over Other Jurisdictions

- Liechtenstein offers both Trusts and Foundations.

- Flexibility– Foundations and Trusts can be structured to be irrevocable, revocable, discretionary, non-discretionary, grantor or non-grantor.

- Protection of Privacy – Registration of private foundations is mandatory but identity of the founder or beneficiaries is not disclosed. Trusts will need to be registered or deposited within 12 months of their existence, though registration does not require disclosure of the settlor or beneficiaries. Neither foundation of trust documents are subject to disclosure.

- Liechtenstein court cases are not public. Contrary to this, cases in countries such as Jersey, Guernsey or other common law countries are open to public inspection.

- Asset Protection – Foundations provide limiting legal claims against the settlor and are therefore used for asset protection. Foundations provide a ‘safe haven’ for investments from civil law countries and being a legal entity, can be used like a corporation. A Liechtenstein Foundation may be suitable for holding items such as paintings and cash for preservation and long-term family planning.

- Foundations may make use of double tax treaties with countries such as Singapore, Hong Kong, United Kingdom and Switzerland and are reliable planning tools for holding purposes.

- Foundations may be subject to the common reporting standard (CRS), classified either as a Financial Institution (FI), passive NFE or active NFE (Holding). A Foundation can be easily classified as an active NFE if substantially all of its activities consist of holding, which is exempt from CRS reporting.

- Greater Beneficiary rights under Liechtenstein Trusts compared to those in Hong Kong, New Zealand, BVI, UK, Guernsey or Jersey. For example the Settlor can decide whether any or all of the beneficiaries have the rights to inspect the Trust’s financial accounts or correspondence. There is also no obligation to disclose beneficiaries to the banks until there is a distribution.

- Liechtenstein is white-listed under OECD, FATF and the European Union and is not considered offshore as there is a corporate tax of 12.5 % that applies to all profits, though there is no tax on dividends or capital gains on shares, and no such taxation for trusts. Trusts are only subject to a flat tax rate of CHF1‘800. Foundations may (with a limited purpose) also qualify to pay only a flat rate of CHF1'800 per year.

- Liechtenstein Trusts and Foundations can provide stronger creditor protection and if structured properly, can be flexible on matrimonial and inheritance issues. The reason behind this is that such legal protections are not directly governed by trust law, but by donation law and creditor’s rights expire after 2 years.

- PTCs (Private Trust Companies) can be used for any Liechtenstein Foundation or Trust.

- Greater Client Protection – The Trusts environment in Liechtenstein is supervised by the Financial Market Authority (www.fma-li.li), which ensures client protection by monitoring the licensing requirements and the compliance with the licensing conditions as well as by cooperating with various authorities such as the Courts, Association of Professional Trustees, Office of Public Prosecutors and the Financial Intelligence Unit. Clients are also protected through the established Professional Ethics Committee and the Trustees' Arbitrary Committee.

About ATU

Founded in 1929, Allgemeines Treuunternehmen (ATU) is one of Liechtenstein’s first and most traditional trust companies with subsidiaries and offices in various major financial centres. Thanks to our broad range of experience we are familiar with numerous foreign jurisdictions and are able to adjust our proposed solutions to international legal and business situations.