Trade Credit Insurance – Protect and Grow Your Business in Difficult Times

Author: Euler Hermes

www.eulerhermes.sg

The Covid-19 crisis is turning into a payment crisis as companies tend to protect their working capital by delaying payments to their suppliers. Defaults and insolvencies loom ahead. Companies need to understand structural payment patterns to help them identify and steer away from bad payers in order to find their way back to growth.

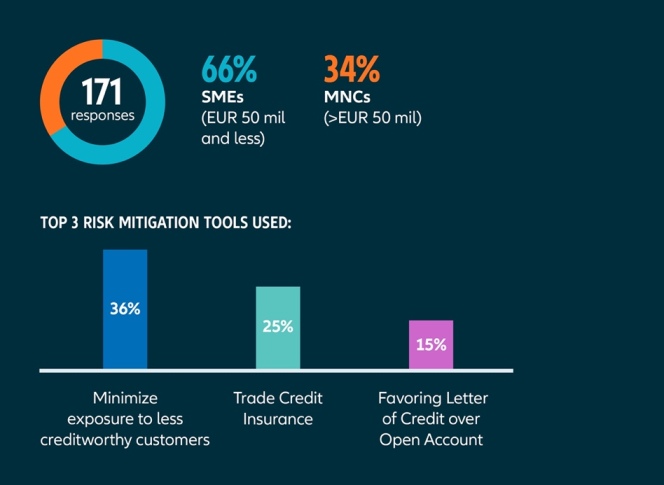

A survey conducted last year by Euler Hermes Asia Pacific, in which a total of 171 Chief Financial Officers (CFOs) and Finance Directors in the region participated, revealed that a compelling percentage of companies have suffered from different levels of unpaid receivables (73%) and delayed payments (82%) over the past three years. The survey, which was conducted between December 2019 and February 2020, also revealed that only 25% of the respondents used Trade Credit Insurance as a risk mitigation tool.

Gaps in trade credit risk protection in Asia Pacific

Trade credit insurance, being one of the most effective credit risk mitigation tools, is crucial in helping companies identify new sales opportunities, grow their business confidently and protect cash flow. However, only approximately 5% of businesses in APAC buy trade credit insurance, compared to a much higher market penetration rate in mature markets such as Western Europe. Asia Pacific is a diverse region when it comes to trade credit risk management maturity level. We have more mature markets such as Australia, Hong Kong, Singapore and Japan where most multinational and large sized companies are involved in some extent of trade credit risk management. Emerging markets such as Malaysia, Indonesia, Thailand and China lack overall level of trade credit risk management knowledge and most companies rely on self-insurance. This, unfortunately, is an inefficient way of managing cashflow and an obstacle for growth. In general, the gap in APAC is the awareness of trade credit risk protection of small to medium enterprises (SMEs).

So, what is Trade Credit Insurance?

Trade credit insurance, sometimes also known as Accounts Receivable Insurance, protects your business in the event of a customer failing to pay a trade debt.

Why is Trade Credit Insurance important?

Trade debts or accounts receivables can make up 40% or more of business assets. Just a few instances of defaults can make a big impact on your cash flow. The cost to a business of non-payment can be considerable. If you have a 5% profit margin and suffer a $100,000 debt, you’ll need to win new sales of $2 million to make up for the lost profits.

In addition, your financial position can be weakened by bad debts in other ways. For example, due to adverse cash flow situation, you will have less capacity for investment. Banks and finance providers could also charge you higher interest, to protect their financing positions. The morale of your employees may be affected if they become worried about their future in the business and their employment. These consequences are worth consideration when weighing up the costs and benefits of trade credit insurance.

You should consider investing in Trade Credit Insurance if you are looking to:

- Grow your sales safely and with confidence through new and existing customers

- Access better financing terms to capture more revenue opportunities

- Maintain cash flow and profitability by mitigating your risk of bad debt

- Make the best possible business decisions by accessing your risk data easily

- Protect your business against non-payment and catastrophic losses

- Expand into new international markets, backed by unique export risks and market knowledge provided by the insurance underwriter, to make accurate growth decisions

- Reduce bad-debt reserves and free up capital

For more information on how Trade Credit Insurance can protect and grow your business, please contact Euler Hermes Specialists via your Zetland account manager (vaniac@zetland.biz or intray@zetland.biz)

Disclaimer:

- Zetland is not a licensed insurance intermediary of Euler Hermes; and therefore does not undertake introduction of and/or advice on any Euler Hermes insurance products;

- Zetland is not responsible for arranging any insurance policy and, for this purpose, you should only deal directly with Euler Hermes;

- Zetland does not represent Euler Hermes and has no involvement in the arrangement of the insurance policy;

- Euler Hermes disclaims all liability for any advice in relation to the insurance policy that may have been given to me/us by Zetland;