Hong Kong Trusts: Structure, Tax Benefits & 2025 Regulatory Updates

Hong Kong trusts offer tax efficiency, asset protection, and flexibility for wealth planning, backed by robust laws and 2025 regulatory updates.

Hong Kong trusts offer tax efficiency, asset protection, and flexibility for wealth planning, backed by robust laws and 2025 regulatory updates.

Learn how trusts and foundations can help preserve your wealth and plan for the future. Discover the advantages of these powerful tools for succession.

The Hestia Fixed Income Trust Account offers a secure investment option with stable returns for conservative investors looking to grow their wealth steadily.

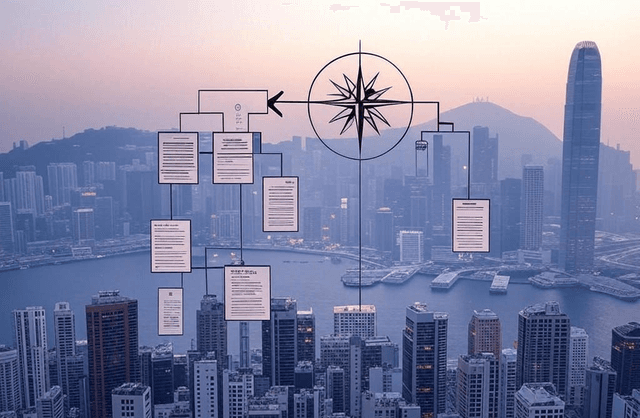

Discover the benefits of setting up a Private Trust Company (PTC) in Hong Kong for managing family wealth. Increase flexibility and control over assets.

Discover how to navigate the complexities of estate planning and tax law to protect your assets and ensure a smooth transfer of wealth to your heirs.

Learn how to safeguard your assets in our exclusive interview with top experts. Discover strategies to protect your wealth and secure your financial future.

Learn how family offices can help high-net-worth families manage their wealth effectively, with expert advice on investments, estate planning, and more.

Learn about the importance of family trust in marriage, and how it relates to both theory and practice. Discover key strategies for building a strong foundation in your...