Hong Kong's tax system is simple and straightforward, with a low tax rate and various incentives for businesses and individuals. However, navigating the tax landscape can still be a challenge, especially for those unfamiliar with the local laws a...

Zetland Blog

Zetland Blog

Read Zetland’s latest articles on market trends and development.

Hong Kong's tax system is simple and straightforward, with a low tax rate and various incentives for businesses and individuals. However, navigating the tax landscape can still be a challenge, especially for those unfamiliar with the local laws a...

As businesses strive for growth and expansion, leveraging professional corporate services can provide valuable support and strategic advantages. Hong Kong, with its business-friendly environment, offers a range of corporate services to facilitate and...

In today's business landscape, corporate compliance is of utmost importance. Hong Kong has a robust legal and regulatory framework that businesses must navigate to ensure adherence and mitigate potential risks. Let's explore the significance of co...

Accurate and transparent financial reporting is essential for businesses operating in Hong Kong. Understanding and adhering to the local accounting standards is crucial to ensure compliance and provide stakeholders with reliable information. Let's...

Hong Kong is known for its favorable tax regime, offering numerous opportunities for businesses to maximize tax efficiency. By implementing effective tax strategies, businesses can optimize their financial position and enhance competitiveness. Her...

Technology and innovation are rapidly transforming the corporate services industry, revolutionizing the way businesses operate and interact with their clients. In Hong Kong, the adoption of technology and digitalization has become increasingly im...

When it comes to safeguarding assets, estate planning, and managing wealth, trusts and foundations provide powerful tools. Hong Kong offers a robust framework for establishing and administering trusts and foundations, presenting numerous benefits ...

Hong Kong is a vibrant hub for business and entrepreneurship, attracting countless individuals and companies seeking to establish a presence in Asia. If you're considering company registration in Hong Kong, it's crucial to navigate the local busin...

The new Economic Crime (Transparency and Enforcement) Bill was passed by Parliament in March 2022 and the new Register of Overseas entities is enforced and and held by UK Companies House. This is to ensure that the disclosure requirements for both ...

Pursuant to the HKSAR Government’s press release issued on October 5, 2021, Hong Kong has committed to amending its tax law by the end of year 2022 with new regulations taking effect on 1 January 2023, with no grandfathering arrangements.In its pre...

BackgroundCurrently, the Companies Register (“the Register”) maintained by the Companies Registry (“the Registry”) contains personal information available for public inspection. Such personal information includes, among other data, the usual ...

Opening a bank account with a traditional bank has been increasingly difficult since a few years ago especially in Hong Kong and Singapore. Banks have tighten their due diligence requirements and some banks only accept specific businesses. There has ...

Singapore is seeking to cement itself as a key player for cryptocurrency-related businesses as financial centres around the world grapple with approaches to handle one of the fastest growing areas of finance. Cryptocurrencies have a place in Singapor...

The Hestia Fixed Income Trust Account is a joint collaboration between Zetland Trustees Limited and Business Class Group. It has been designed with simplicity and tax efficiency in mind, and has two main objectives. The first to provide its Owner wit...

With effect from 3 September 2021, the Singapore Exchange (SGX) has announced new rules that enable Special Purpose Acquisition Companies (SPACs) to list on its Mainboard of the Singapore Exchange Securities Trading Limited. The SPAC Framework covers...

The Financial Services Authority (“FSA”) would like to draw the attention of all International Business Companies (“IBCs”), Foundations, Limited Partnerships and Trusts (together referred herein to as “legal persons and legal arrangements�...

A Professional Indemnity (PI) insurance policy provides protection for businesses offering advice or services to third parties. In today’s business world, where others are eager to gain advantage, litigation is increasing. Any claims against you, b...

China will step up its efforts to address global digital tax rules. China outlined its plan in the 14th Five-Year Plan period (2021-2025) at the the Belt and Road Initiative Tax Administration Cooperation Forum (BRITACOF) on Sept 7, through “Accele...

In general, eligible individuals will get their Stimulus Payments (also known as Economic Impact Payments) automatically and won’t need to take additional action. The IRS uses available information to determine the eligibility and issue the payment...

Author: Virtuzone - https://www.vz.ae/Starting a business overseas can be a daunting prospect. When the foreign country in question is the UAE, however, it is anything but. The Emirates has an incredibly welcoming and supportive business environment....

Australian crypto investors must report their profits to the Australian Tax Office (ATO) or risk penalties and tax audits. Crypto is classed by the ATO as an asset, not a currency. The ATO is concerned that many taxpayers believe their cryptocurrency...

Starting a new business is exciting. This is particularly true for the “new commerce” industry including e-commerce. The pandemic has given the industry a new boost as well. Location independence is another appealing factor of an e-commerce busi...

What is economic substance and why does it exist?The OECD Forum on Harmful Tax Practices (FHTP), a sub-body of the Base Erosion and Profit Shifting (BEPS) Inclusive Framework, defined the global standard that requires companies to have substantial ec...

China will extend the duration of many tax relief measures this year including institutional tax reduction, broadening the band of small-scale VAT taxpayers, implementation of new structural tax reductions and policy adjustments. The VAT threshold ...

The Group of Seven (G7) rich nations have recently reached a landmark deal for creation of a global minimum of corporate tax rate of 15%. The tax rate would be used to target mainly the largest and most profitable multinational companies (“MNCs”)...

In general, moving overseas to work or live has become a norm as the world globalises. We have noticed recently that an increasing number of native Hong Kong persons holding a BN (O) passport planning to migrate overseas for a better quality of life...

Author: Euler Hermes www.eulerhermes.sg The Covid-19 crisis is turning into a payment crisis as companies tend to protect their working capital by delaying payments to their suppliers. Defaults and insolvencies loom ahead. Companies need to unders...

Everyone at Zetland is reeling from the news that Hong Kong has lost its place as the world’s most expensive city for expatriates (it is now only second). The winner this year is Ashgabat – a city most people have never heard of – capital of Tu...

April, 2021Author: Soteria TrustsIf you, your family members, colleagues or friends are holding UK property this is an excellent opportunity to take advantage of our SDLT Review Service. Its thought that as many as 1 in 4 UK property transactions hav...

April, 2021Author: Dominik StuiberThe growth of family offices has been strong globally and particularly in Asia where a large percentage of private sector businesses are family-owned. Many of the successful businesses are still managed by first gene...

April, 2021Author: Lily ChowA couple of HMRC enquiries (aka latest nudge campaigns) were issued to our clients to clarify their UK tax position. The targets of the campaigns include two specific categories of individuals: those whom HMRC consider ...

April, 2021Author: Su Lee ChanWith Britain’s increasingly complex trading relations with the rest of Europe after the Brexit, Singapore’s role as a hub for UK companies, whether as exporters or investors accessing Southeast Asia’s and broader A...

April, 2021Author: Dominik StuiberConducting any business activity in the UAE is regulated by government authorities and thus requires a trade licence to operate. This applies to the country’s mainland and numerous free zones alike. Having a trade ...

April, 2021Author: Dominik StuiberHong Kong’s status as an international asset and wealth management centre and offers for investment funds has become more comprehensive with recent enhancements of the Open-ended Fund Company (OFC) and the Limited ...

April, 2021Author: Phoebe LuoChina will deepen the reform of tax collection and management to better serve market entities, according to a guideline issued by the general offices of the Communist Party of China Central Committee and the State Council...

January, 2021Author: Manuel Wolffram, Senior Key Account Manager at Klai GmbHOne of the internet’s biggest accomplishments is the ease with which people can access a vast amount of information. A lot of people are searching for information online. ...

January, 2021Author : Kayla LauAsia dominates the Henley Passport Index, a ranking of all the world’s passports according to the number of destinations holders can access visa-free. The Index doesn’t take temporary COVID restrictions into account...

January, 2021Author: Lily ChowA limited company incorporated in Hong Kong must comply with several duties annually, namely accounting, auditing, tax filing, annual return and renewal of employer’s return and business registration certificate to mai...

January, 2021Author: Su Lee ChanIt is Singapore’s goal as a nation to be a leading digital economy. The COVID-19 pandemic has greatly accelerated the pace of digital transformation in Singapore and globally. As more businesses carry out their activ...

January, 2021Author: Phoebe LuoOn 31st December 2020, European Commission President Ursula von der Leyen announced that the European Union and China have come to a Comprehensive Agreement on Investment (“CAI”) after seven years of talks.Firstly, ...

January, 2021Author: Jessica ChakHong Kong has recently announced its plan to revive a corporate rescue bill that was first proposed in 1996. Unlike Singapore, as well as England and Wales, Hong Kong does not currently have a provision for insolvent ...

January, 2021Author: Dominik StuiberDoes the OECD Permanent Establishment Rules conflict with Hong Kong’s established Territorial Source Concept?Earlier this year, the Inland Revenue Department (“IRD”) in Hong Kong published its first tax rulin...

November, 2020Author: Jim SutherlandWe all spend a lot of time working out, avoiding and paying taxes but how much do we think about that other great inevitability – our demise? The recent untimely death in Hong Kong of a longstanding client of Ze...

November, 2020Author: Roger Frick by ATU (Allgemeines Treuunternehmen)Interview with Roger FrickFor over 90 years, Allgemeines Treuunternehmen (ATU), one of Liechtenstein’s first and leading trust companies has been developing tailored wealth ...

November, 2020Author: Dominik StuiberFamily offices have been gaining greater visibility in Asia not just in the private wealth management business. They have become increasingly important to the whole financial services industry. As a financial hub ...

November, 2020Author: Phoebe LuoOn September 11, Ms. Phoebe LUO, General Manager of Zetland Fiduciary Group in China, was honored to be invited by the Shanghai Lawyers Association’s Trust and Marriage & Family Business Research Committees to at...

November, 2020Author: Lily ChowAny US tax obligations for purchasing/selling US real property for non-resident property owners?Foreign individuals and corporations are free to purchase or sell residential or commercial real properties in the United S...

November, 2020This article was contributed by Jason Pearce, Head of Technical Sales, Hong Kong & NE Asia for Quilter International. There have been over 20 changes to the taxation of UK property in the last 8 years, the vast majority being i...

November, 2020Author : Kayla LauThe State Council Launches New Requirements for the Establishment of Financial Holding CompaniesChina is increasing its regulatory scrutiny of non-bank financial companies including Ant Group, HNA Group, and Fosun Inte...

November, 2020Author: Su Lee ChanThe latest amendments to the International Arbitration Act (“IAA”) have made essential changes that will further facilitate and streamline the arbitration process to further establish Singapore as a world class i...

September, 2020Author: Dominik StuiberSetting up a business in the UAE is a dream of many. The UAE connect Europe and Asia and serve as the favoured entry point to the African continent creating a robust economy and growth prospects. The ease of doin...

September, 2020Author: Roger FrickThis article was contributed by ATU (Allgemeines Treuunternehmen), an independent fiduciary service provider in Vaduz, Liechtenstein.In August 2013, China became the 56th signatory to the Multilateral Convention on M...

September, 2020This source was attributed by China Economic ReviewChina and Russia ditch dollar in move towards ‘financial alliance’Russia and China are partnering to reduce their dependence on the dollar — a development some experts say could ...

September, 2020Author: Tetyana AshurovaThe New Zealand Trusts Act 2019 that will come into force on 30 January 2021 is the first major trust law reform in almost 70 years and applies to all express trusts that are governed by New Zealand law, includi...

September, 2020Author: Kevin LeiThe UK has a highly evolved system of taxation and planning helps to limit exposure and protect wealth. Two issues in particular should be considered before any move to the UK.Clean CapitalAny income or gains which hav...

September, 2020Author: Phoebe LuoFinancial news agency Bloomberg has reported that China has launched an initiative to identify and locate Chinese citizens living outside of China and charge tax on their worldwide income, starting with those in Hong ...

September, 2020Author: Dominik StuiberAn introduction to Hong Kong’s New Limited Partnership Fund (“LPF”) Law for Private Equity and Venture CapitalHong Kong is currently the second largest private equity (“PE”) centre in Asia after Mainlan...

September, 2020Author: Su Lee Chan The landscape of regulatory compliance across the world is constantly evolving with increasingly stringent requirements across all types of industries. Congratulations to those who have setup a Singapore company r...

Author: Dominik StuiberIntroducing Interim.works by Gemini PersonnelInterim.works is a platform for Interim Managers and businesses to connect and find opportunities for collaboration. Interim management is the provision of effective business solutio...

Author: James C SutherlandIn recent weeks because of the protests in Hong Kong and the words and actions of the US and Chinese governments many people have asked whether the territory still has a future.It is true that Hong Kong’s importance to Chi...

Author: Lily Chow Our clients have recently raised queries on the Economic Impact Payment (EIP) pursuant to the COVID-19 relief issued by the IRS, such as: - Am I eligible for the economic impact payment? - &nbs...

Author : Dominik Stuiber Trademark rights are territorial in nature and are granted in the jurisdiction they are applied for and registered according to its laws and practices. In principle, a trademark needs to be registered in each jurisdictio...

Author: Kayla Lau To boost economies, most countries in the Caribbean offer residence to foreigners through investment. This attracts skilled workers as well as opening up doors to individuals who wish to live, work and school in the host co...

Author: Roger Frick This article was contributed by ATU (Allgemeines Treuunternehmen), an independent fiduciary service provider in Vaduz, Liechtenstein. Legal Liechtenstein is situated in between Switzerland and Austria, in the centre of the A...

Author: Phoebe Luo I. Preferential Policies for Taxpayers with Value-added Tax The policy that is effective from March 1 to December 31, 2020 is applicable to small scale taxpayers throughout China. Measures differ slightly for ...

Author: Su Lee Chan New requirements to lodge information on Singapore's register of registrable controllers from May 2020 The Accounting and Corporate Regulatory Authority of Singapore (“ACRA”) has extended its deadline to...

With the recent spread of the corona virus and halt of work and production, tax authorities in China have implemented a series of measures introduced by General Secretary Xi Jingping to contain and control the epidemic while work resumes. The CPC Cen...

In Singapore’s 2020 Budget, the plan from 2018 to raise GST in the city state to 9% between 2021 to 2025 was confirmed not to take effect in 2021. GST in Singapore will remain at its current rate of 7%. A rebate of 25% on the corporate income taxes...

On 26 February 2020, Financial Secretary, Mr Paul Chan Mo-po, GBM, GBS, MH, JP,[1] delivered the government’s 2020/2021 Budget Plan to the Legislative Council.Given the tough economic environment, an expansionary fiscal stance is being adopted maki...

Many investors or businessmen are interested in investing in Hong Kong or have already set up limited liability companies in Hong Kong. Most have one question on their mind: ‘How do I pay less tax?’ Do I need to pay tax immediately after filing ...

Business Succession PlanningMany business owners are often focused on 'today' often neglect planning for the future, and in particular to a future in which they will not play a part. As a result many businesses do not survive beyond the first generat...

EU efforts and the work of international bodies targeting tax neutral jurisdictions are not a new policy. Following the EU’s inter-governmental Code of Conduct Group (Business Taxation) report in 2018, no or nominal tax jurisdictions including the ...

Digital banking penetration across Asia has been increasing rapidly. The competition for Asia’s banks to deliver superior digital experiences and reinvent customer acquisition strategies began last year, and is marking the next chapter in Singapore...

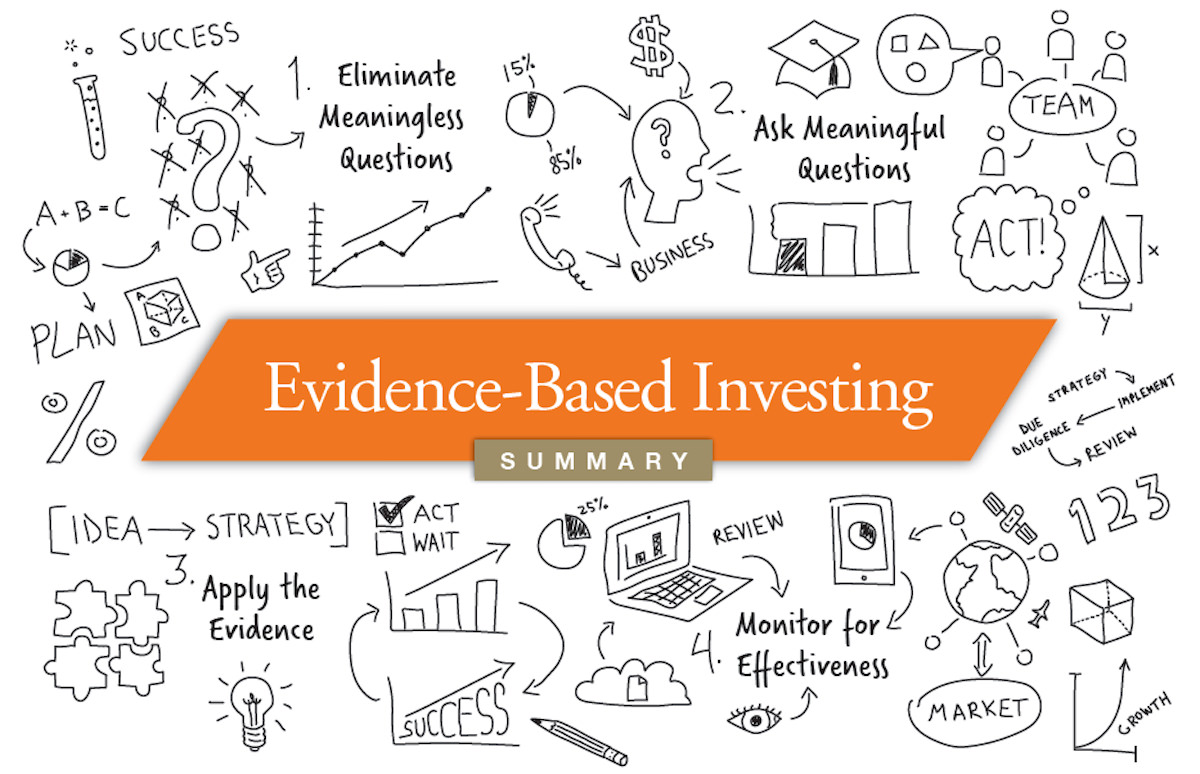

The article was contributed by Private Capital Limited, an independent fee-only investment and wealth management company. For more information, please feel free to contact Mathew Bate at bate@private-capital.com.hk. The Evidence on the Evidence:There...

This article was contributed by Professional Wills Limited. For more information, please feel free to contact Professional Wills Ltd at enquiry@profwills.com/ +852 2561 9031 or Zetland at intray@zetland.biz/ +852 3552 9085. WillLegally, any child und...

Regulations for the Implementation of the Foreign Investment Law came into effect on January 1On December 13th of last year, the state council adopted the draft regulations of the foreign investment law to implement measures to promote and protect fo...

Taxes, regulations, infrastructure, economic stability and reputation or perception are some of the main factors to consider when choosing a domicile to setup your business. Onshore or mid-shore companies are gaining more interest as offshore jurisdi...

According to a survey report on global start-up ecosystem, Hong Kong is ranked among the top 25 global startup ecosystems for the first time in 2019.At the same time, Hong Kong was listed as the third most innovative location in South East Asia, East...

HKTaxHave you received your tax assessment yet? ‘Why have I still not received the tax demand note?’, you may ask.The Inland Revenue Department (“IRD”) has issued a notice on their website advising that the Inland Revenue (Amendment) (Tax Con...

The EU’s 5th Anti-Money Laundering Directive (AMLD) was to be transposed into national law by Member States by 10th Jan 2020. The Directive builds on earlier directives, intending to catch up to international standards. Among other measures that wi...

VCC is a new legal entity or structure for all types of investment funds in Singapore. It can be formed as a single standalone fund, or as an umbrella fund with two or more sub-funds, each holding different assets. With the introduction of the VCC st...

China is implementing a new law to strengthen the rights and protection of foreign invested businesses in China. China has been critiqued for discriminating against foreign businesses and restricting their access to specific industries, markets and c...

HKHong Kong is one of the leading cities in Asia for conducting business. Hong Kong ranked fifth in “ease of starting business” in the World Bank’s Ease of Doing Business 2019 Scorewww.doingbusiness.org/en/data/doing-business-score This demonst...

A Limited Liability Company or LLC is a hybrid between two familiar business structures, namely a corporation and a partnership. A LLC combines the best of both worlds by offering the advantage of both a corporation and a partnership without the disa...

This article will give you a brief summary of the Hong Kong salaries tax filing obligations of employers under the Inland Revenue Ordinance (IRO). Meaning of EmployeeEmployees are:persons employed by Hong Kong entities, regardless of the persons’ r...

In the early summer of this year, Zetland Fiduciary Group Limited and Tianyuan Law Firm Hangzhou Branch held a family wealth management meeting beside the beautiful West Lake in Hangzhou. At the end of August, Zetland joined hands with Tianyuan Law F...

On June 19th, 2019, Zetland Fiduciary Group Limited, together with Tianyuan Law Firm and Zhongrong Trust Family Office, held the family wealth management sharing meeting by the beautiful West Lake. Many professionals from the banking, legal and inves...

As a non-resident working in Hong Kong, you are liable to salaries tax but not all income is chargeable. This article will give you details on chargeable and non-chargeable income, and tax clearance when leaving Hong Kong. Chargeable and Non-chargeab...

UK banks have relaxed their strict mortgage lending criteria. Interest Only loans can now be accessed via a growing number of Private Banks. This sudden competition has also led to low arrangement fees and competitive interest rates.All nationalities...

The primary benefit of a trust is that it allows the legal ownership of property to be distinguished and separately vested from the enforceable rights of use and enjoyment of that property. Belize’s Trust Law is one of the strongest and most flexib...

WillIn many countries you can buy kit Wills from the stationers or post office. You can download a template Will from the internet – even for your own country, but these options are fraught with dangers. Common sense dictates that it is an importan...

Hong Kong has become the first member jurisdiction in the Asia-Pacific region to have achieved an overall compliant result as regards its anti-money laundering and counter-terrorist financing (“AML/CTF”) regime in the mutual evaluation undertaken...

After almost three months of anti-government protests in Hong Kong, there are hopeful signs that cool heads may yet prevail. Boase Cohen & Collins Senior Partner Colin Cohen, whose love for the city runs deep after almost 40 years as a resident, ...

China TaxChina’s State Bureau of Taxation announced the special individual income tax deductions which was implemented on 1st January 2019, to lower the overall tax burden for certain individuals. The deductions relate to six areas, including child...

What is Tax Residency Certificate?A Tax Residency Certificate is a document issued by the competent authority in Hong Kong to a Hong Kong resident who requires proof of resident status for the purposes of claiming tax benefits under the Comprehensive...

On April 13-14th, the International Trust Law Frontier Forum was held in Tianjin on the occasion of the 100th anniversary of Nankai University. Ms. Phoebe Luo Jia, General Manager of Zetland Fiduciary Group China, was invited to attend and speak on b...

In December 2018, the characteristics of an International Business Company (IBC) in Belize was substantially modified with regards to the definition of resident company and IBCs with special licenses are to comply with physical presence requirements....

OverviewChina and Singapore have signed a bilateral free trade deal, which will allow greater market access for Singapore companies. The agreement grants Singapore businesses preferential treatment, which leads to lower tariffs, for the export of cer...

On March 26, Hong Kong and Australia signed a Free Trade Agreement (“FTA”) and an Investment Agreement (“IA”) (together the “Agreements”), which covers trade in goods and services, and investment in areas including intellectual property, ...

Virtual banks have finally arrived in Hong Kong, further developing the city’s smart banking and Fintech industry. On 27 March 2019, under the Banking Ordinance, the Hong Kong Monetary Authority (HKMA) granted the first three virtual banking licens...

On March 12, 2019, the European Commission removed Hong Kong from the European Union’s watchlist on non-cooperative tax jurisdictions. The decision was welcomed by the Hong Kong Government. Hong Kong’s Secretary for Finance Services & Treasur...

The Chinese government carried out a large-scale tax cut in 2019. In January 2019, the Ministry of Finance issued a notice to implement the policy of inclusive tax relief for small and micro enterprises, and implemented an inclusive tax reduction and...

Hong Kong is suffering a miniature measles epidemic especially amongst Cathay Pacific staff. Readers may be amused by the following exchange…. From: Jim Sutherland To all Staff at Zetland It was good to see everyone at the birthday party last Frida...

The European Union (EU) on March 12th, 2019 issued its list of “non-cooperative jurisdictions for tax purposes,” which includes Belize among the ten new black listed countries. The Government of Belize (GOB) in a press release on that same day ex...

The theme of “Global Tax Transparent Compliance Trust Structure Trend and US Investment Environment” was successfully held On March 1, 2019, Zetland Fiduciary Group, in collaboration with the Nautilus Family Office, co-organized a private ev...

BackgroundThe EU code of conduct Group (“the Code Group”) has assessed the tax policies of BVI in 2017 and opine that BVI should be included in a list of jurisdictions which were required to address the Code Group’s concerns about “economic s...

IntroductionOn 27 February 2019, the Financial Secretary of Hong Kong announced the Budget for the fiscal year 2019-2020. The forecast is that for the fiscal year 2018-19, there will be a surplus of HKD 58.7 billion, and that the fiscal reserves will...

On 24 October 2018, the Inland Revenue (“IRD”) (Amendment) (No. 3) Bill 2018 (“Bill”) was passed by the Legislative Council. The introduction of this bill is a first step to encourage more the research and development (“R&D”) activiti...

New amendments have been made to the International Business Companies Act, Chapter 270 of the Laws of Belize, Revised Edition 2011. The features, advantages of and restrictions on an International Business Company (IBC) have been substantially modifi...

Theme Family Trust Private Sharing Conference Successfully HeldChinaOn 14th December, 2018, Zetland Fiduciary Group and Beijing King & Capital Family Trust Legal Affairs Center jointly held a private sharing conference themed "How to establish an...

The Global Investor Program (GIP) is a permanent residence scheme in Singapore which allows eligible investors and their families to acquire Singapore Permanent Residence (PR) status in the country. Eligibility Criteria The GIP is applicable to ...

As you may be aware that the trade war between China and US started in June last year has never ended and recently there is a meeting between President Donald Trump and Chinese President Xi Jinping in December, seems like that have sought out some ag...

Set up a business in Hong Kong is fast and easy. A Private Limited Company is the most commonly-used legal entity in Hong Kong that is separate and distinct from the individuals who run it. Before setting up a Hong Kong company you should be aware ab...